In a recent article I presented an overview of the progress of digital transformation in terms of the collective success achieved by the insurance industry over the last decade. Some of the findings of my detailed research were certainly thought-provoking but in some instances quite controversial.

The topic of innovation and disruption in insurance is an equally interesting topic. Insurance is an old traditional and highly regulated industry with many established incumbents (some more than 150 years old) who have honed and optimised their actuarial models to be able to price and segment the risk categories relating to their retail or commercial customers. Traditionally these incumbents have been incredibly cautious in their approach which is probably why they have survived this long. Until recently these insurers have been reluctant to adapt and transform their businesses. However, this is no longer the case as these incumbents are facing increasing challenges brought about by new technology innovation that is changing customer expectations, in many cases driven by new entrants.

InsurTech (Insurance & Technology) refers to the use of technology innovation designed to transform the current insurance industry model through better customer-centricity, better efficiency, better insight from data to assess risk more accurately and produce personalised pricing etc.

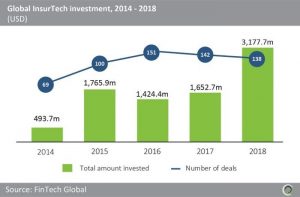

This wave of innovation and disruption has been brought about by InsurTech which initially emerged as early as 2010. A huge amount of investment has gone into these InsurTech start-ups with significant escalating growth since 2010, now exceeding 8.5 billion U.S. dollars representing some 600 deals. Investment almost doubled from over 1.6 billion in 2017 to almost 3.2 billion US dollars last year. InsurTech deals have been shifting from North America, which had the lion share over the last 5 years, to Europe which by last year commanded more than a 1/3 of global deals (more than half of which in Berlin). Asia still lags behind with around 14% share. In general InsurTech investments have focused on P&C rather than Life (> 65%) and more on retail than commercial (> 75%)

Investment in InsurTech start-ups has exceeded 8.5 billion U.S. dollars since 2010

86% of insurance incumbents believe Innovation must happen at an increasingly rapid pace to retain a competitive edge

Insurers now recognise the need to evolve and the importance of technology innovation which has fuelled the disruption especially from InsurTech. 87% of insurers agree technology is no longer advancing in a linear fashion, but rather at an exponential rate and 86% believe Innovation must happen at an increasingly rapid pace to retain a competitive edge [Source: Accenture]. However, most traditional insurers seem to perceive that start-ups pose less of a threat to their businesses than existing competitors. Whilst Start-ups can execute at pace they still need to operate and establish themselves in a regulated industry which can take a long time to get off the ground. They may also need the help and expertise from traditional insures to handle underwriting and also draw upon sustainable capital.

Is there tangible evidence of major ‘game-changing’ disruptions in the industry brought about by InsurTech start-ups?

The question that I would like to pose in this article is this: Is there tangible evidence of major ‘game-changing’ disruptions in the industry brought about by InsurTech start-ups? How many of these start-ups have started to eat the incumbents’ lunch operating independently and experiencing significant growth? On the other hand if InsurTech start-ups have not been a real threat to incumbents, did they represent more of an opportunity working collaboratively with incumbents within technology-driven ecosystems? What is the role that InsurTech played and how successful has the ‘old’ and ‘new’ got on in the transformation and modernisation of the industry by integrating new innovative ideas into the well-established albeit traditional world of the incumbents.

So let’s start with the big picture. There are hundreds of InsurTech start-ups that are delivering some great innovative ideas covering specific areas of the insurance value chain. There are numerous infographics that capture a sample of the constantly evolving InsurTech universe categorised based on the areas they cover and count. One such infographic is presented below (based on a graphic by Venture Scanner).

It is not my intention to present a holistic view of all these companies and how they have contributed to the innovative disruption of the insurance industry but I am going to pick a few that stand out in my view especially with reference to the question that I am posing in this article.

In a session last year on “Digital Insurance Around the World” (hosted by The Digital Insurer/KPMG), I was on a panel of experts which included Young Yang from Zhong An Tech. I recall how impressed I was with the tremendous growth of this company and decided to research it further. Zhong An was established in 2013 as a pure-play digital online insurance company in China. Here are some interesting facts about this company:

- Largest online-only insurer in China

- 432M Customers since 2013

- 10bn policies sold

- 60% of its customers have an average age 18-39

- Operates within 5 Major ecosystems (lifestyle consumption, Travel, Health, Consumer Finance and Auto) and 307 ecosystem partners

- 55% of staff are Technologists

- Investment in Technology in last 3 years at 2.8%, 6.3% & 8.7% of revenue

- Has been through Technology transformations: Technology 1.0 – Cloud; Technology 2.0 – Open Platform; Technology 3.0 – Everywhere

- In September 2017, the company went public in Hong Kong as the first InsurTech company to be listed on the city’s market, raising 1.5 billion US dollars.

Zhong An has certainly succeeded in disrupting the insurance market in China and becoming a leader with 30% market share in such a short period of time. The secret for its success lies in the following:

- Total focus on customers and solving their problems. They make it their business to look at how society is evolving to identify customer current and future needs and develop products/services to meet those changing needs. They create solutions to customers’ problems. And they’re doing it using insight from the latest intelligent technologies.

- Extensive utilisation of data and analytics, which ensures accurate product pricing and risk control. Zhong An is claimed to hold around 2000 data points per customer!

- Technology evolution is digital and in the cloud. Its powerful digital capabilities allow the company to meet its customer demands dealing with huge volumes, high frequency and at low cost. As an example, a customer can buy travel insurance at the airport, if the flight has been delayed, Zhong An will settle the claim while customer is still waiting for the flight.

- Hugely effective ecosystem and the partnerships model: Zhong An uses behavioural data from more than 300 partnerships to identify moments in which the customer can use an insurance product. These digital ecosystems create channels through which the carrier can sell its insurance products.

Should incumbent insurance companies in the UK be worried? It is rumoured that Zhong An is already exploring markets in Central Europe and the Nordics!

Another Chinese company that is worth a quick mention is We Sure (a Tencent company) which enables users to make purchases, inquiries and claims directly through the mini program ecosystem within We Chat (Chinese multi-purpose messaging, social media and mobile payment app developed by Tencent with over 1 billion monthly active users). We Sure offers products covering health, motor, life and travel, and is able to recommend products personalised to a user’s needs by leveraging We Chat’s data and social connections. It was launched in November 2017, and within a year it has more than 20 million monthly active users. The extreme growth is seen as the result of multiple factors, including high NPS, 50% product referral rate, 20 insurance and reinsurance partnerships (developing new products in just 1.5 to 2 months, on average).

A selection of my other favourite start-ups that have notably introduced disruption to the industry in some shape or form (some of which I have come across professionally and explored directly) include:

1. General Insurance

Lemonade (US): Lemonade is a digital insurer founded in 2015 offering direct home and renters insurance. Company keeps 20% of premium to pay for claims and run the business with any unclaimed premium going to a non-profit of customer choice. The company uses artificial intelligence and behavioural economics in the form of chatbots to handle claims and provide insurance policies. The app “A.I. Jim” handles policyholder claims, and while you are filing a claim, the app reviews and processes, cross-references against the policy and either approves/disapproves a claim. Policies can be purchased and claims paid often within a few minutes or less. Lemonade raised significant funding (c. 200 million US dollars) from VG, XL-Catlin and also Allianz. In my view Lemonade demonstrated how home insurance can be done more effectively and with a real social purpose.

Insurify (US): Digital insurer that uses artificial intelligence to provide a motor insurance quote simply by texting a copy of your car’s license plate (compare this with your individual experiences filling multiple forms to get a quote). The company launched in 2016 works through more than 80 partners and uses a virtual insurance agency called “Evia.” Evia stands for Expert Virtual Insurance Agent which gathers driving data and driving record information, which saves customers time in obtaining an accurate motor insurance quote based on user’s unique risk profile. Great idea to simplify the process which many UK insurers have been striving to develop.

Laka (UK): In my view Tobias Taupitz and his team have introduced an interesting variable subscription insurance model (rather than fixed annual premium) which is targeting biking enthusiasts at this stage. Unintuitive perhaps, but more claims means more profit to the company. It operates as a MGA and partner with an incumbent on a fee-share basis.

Neos (UK): Is effectively a connected home insurance offering that uses technology in the form of smart sensors and an App to help prevent situations that could result in claims. Customers are alerted to problems such as pipe leaks via a smartphone app enabling action to be taken (by customer or automatically) to prevent further damage.

By Mile (UK): Pay by mile insurance, basic annual payment then pay per mile. Uses a Tracker that is installed in vehicle and an App.

Metromile (US): Pay as you go digital auto insurance founded in 2011 offering auto insurance to low mileage drivers through a telematics device installed on vehicle that measures the miles you drive. Metromile also offers a smart driving app that offers features for trip optimization, stolen vehicle, car health diagnostics and street sweeping alerts to help avoid tickets.

Marmalade (UK): Specialist auto insurer broker for young drivers (90% aged between 17 and 19) where Allianz is the solus underwriter – rewards good drivers based on an overall driving score.

MicroEnsure (UK): Insurance focussed on customers in emerging markets globally.

2. Health

Oscar Health (US): Founded in 2013 and employs technology, design, and data to improve and humanise health care. Its customers can actively reduce their insurance premiums through exercise (Vitality parallel?) where policyholders are provided with free wearable fitness trackers integrated to Oscar App which can be used to get a call back from a doctor or get prescriptions sent to a preferred pharmacy.

Alan (France): A health insurance platform that is 100% online with zero paper allowing customers (individuals and businesses) to sign up in less than 5 minutes. Claims some 30,000 customers since its launch in 2016. Offers telemedicine appointments via its platform.

Clover Health (US): Founded in 2013 and so far raised nearly a billion US dollars in funding. It uses a data-driven system to allow for more in-depth personalisation and better correlation between member experience, clinical profiles and clinical outcomes to reduce avoidable spending and combat chronic diseases. It currently has around 40,000 members.

3. Specialist Support Models

Shift Technology: a Software-as-a-Service solution that draws on big data analytics and machine learning technology to spot patterns of fraudulent activity in insurance claims working with claims handlers claiming a portfolio of more than 70 insurers.

Leakbot: Smart Water leak alarm, Homeserve owned.

Carpedata: Risk prediction for insurers.

Bright Box: AI Connected car telematics platform acquired by Zurich in 2017.

Omniscience: Automation for underwriters.

Instanda: SaaS policy administration platform that enables fast development and launch of insurance products online.

Quantemplate (UK): Another Allianz X investment, it provides data management and analytics solutions powered by machine learning technology which helps commercial insurance clients rapidly turn raw data into actionable insights.

I could go on describing the achievements of many other InsurTech start-ups….. but that is not the main objective of this article.

How do we assess the role InsurTech start-ups have played in disrupting the insurance industry? I am sure there are various views and opinions out there which I hope this article will act as a catalyst to encourage input and debate.

Investment in InsurTech start-ups is by no means diminished, in fact it is still on the rise

Here are my takeaways:

Venture Capital and Private Equity Firms continue to pour significant amounts of money investing in InsurTech with ambitions to take on the incumbents directly no longer regarding them as impenetrable. As an example, Allianz X (The Venture capital arm of the global giant Allianz) had increased its investment pot several fold to 1 billion Euro last year. So the appetite for investment in these start-ups is by no means diminished, in fact it is still on the rise.

InsurTech companies tend to fall into two categories: The B2B companies that offer enterprise propositions to sell to the insurance incumbents e.g. Shift Technology and Quantemplate. These tend to be focused on optimising their offering, becoming better, faster, more efficient and very relevant to incumbents. The other category is the customer-facing start-ups e.g. Lemonade and Zhong An. These tend to focus on proving themselves as sustainable profitable customer-centric digital businesses increasing revenues and thus their market valuation.

Incumbents cannot afford to wait for major disruptions that will wipe their competitive advantage

In essence in my view InsurTech start-ups have contributed to introducing much needed disruptive innovation to the emerging and evolving insurance ecosystems focusing on innovative solutions to customers’ problems. This has awakened incumbents who now recognise they need to accelerate their response as they cannot afford to wait for major disruptions that will wipe out their competitive advantage; they need to be ahead of the curve. The challenge however for them is enormous. According to Accenture survey in 2016 only 38% of insurers were working with start-ups on digital initiatives and only 17% of them had in-house VC funds (I hope the latest 2019 numbers are better!). Insurers need to embrace InsurTech innovation in their businesses through a cultural change. Having clarity on the organisation Innovation agenda is important to determine which start-ups to target.

There are symbiotic relationships between start-ups and incumbents but the challenge is cultural

There is evidence of symbiotic relationships between InsurTech start-ups and traditional incumbents working together to change the face of the insurance industry for the benefit of customers. However, the differences in approach between a 200-year-old insurer and a 30-month-old InsurTech start-up may be challenging to reconcile.

Legacy, silo’d organisation and culture inhibit incumbents’ Speed and Agility

InsurTechs have to contend with the following challenges and opportunities: Complex regulation was and remains a deterrent to new market entrants. The size and scale of incumbents’ in-force books and relatively low attrition makes it harder for InsurTechs to rapidly capture market share. This however will not protect incumbents indefinitely. Incumbents have the advantage of large Solvency II capital reserves (where Start-ups don’t). Start-ups may not have a deep understanding of the industry and access to historical risk/claims proprietary data built on years of experience to assist them with the development of their underwriting and pricing models. However start-ups have the edge when it comes to building direct relationships with customers through capturing and catering for what they need digitally. The incumbents’ notion that insurance is a low-engagement, disintermediated business delegating customer relationships to brokers and agents is out of date. It’s also hard for incumbents to innovate as they have so much to contend with in terms of their legacy, traditional silo’d operating model and culture. Speed and agility are not on their side.

Companies that initiated disruption fared best in terms of generating more revenue

By and large incumbents do not seem to be threatened by start-ups but view them as an opportunity to explore new ideas or use them as accelerators for their business growth. However, this does not mean that incumbents can feel safe and rest on their laurels. There is evidence to show that companies that initiated disruption fared best in terms of generating more revenue [Source: McKinsey] so incremental improvements and tweaks round the edges are simply insufficient in our digital world. Incumbents are approaching this challenge by either building in-house dedicated labs (e.g. AXA and Aviva) where ideas are generated and developed from scratch or alternatively by investing or partnering with start-ups. Some fund technology incubators to develop products and services through test and learn.

Partnerships are critical

For most insurers it would be difficult and somewhat unrealistic to pursue innovation entirely using just their in-house capabilities and initiatives. Partnerships can help them rapidly provide new products or channels, gain expertise, and play in ecosystems beyond insurance or in different geographies. An example is the joint venture Allianz setup with Baidu in China which opened up the vast Chinese market to Allianz leveraging Baidu’s customer analytics.

The emergence of pure online digital insurers can be a real threat to incumbents

We are seeing the strong emergence of pure online digital insurers covering GI, Health, and Travel etc. These well-funded organisations are not constrained by any legacy or traditional silo’d organisational operating models faced by the incumbents. They heavily leverage insight from data, artificial intelligence (AI) / Machine Learning (ML) and work within effective partnerships ecosystem. Some of these have experienced exponential growth and may in time pose a real threat to some of the incumbents.

The strategic role of IT is pivotal to take full advantage of emerging technologies

InsurTech Start-ups’ products leverage technologies such as data analytics, AI/ML, Blockchain and the Internet of Things (IoT). These are critical elements in delivering increased levels of personalisation and better real-world outcomes for customers. The role of IT is central. Many incumbents however do not view IT as a strategic function instead it is seen as a cost centre or support for Operations. Incumbents would need to invest significantly in IT to enable them to take full advantage of these emerging technologies. Externally, IT must enable collaboration with partners by enabling the integration of systems and processes through the Services and API economy.

Agile working practices and associated culture to achieve “Economies of Speed” are an inherent part of a start-up’s DNA.

Start-ups way of working is very different to traditional silo’d operating models. Technology plays an important role where start-ups leverage elastic cloud infrastructure and services which provides them with speed of implementation, flexibility and scalability and at the same time optimising cost. Adoption of Agile/DevOps & test-and-learn practices are gaining significant traction to achieve Continuous Integration & Delivery (CI/CD) to release products & services to their customers in days and weeks rather than (the traditional) months and years. Some incumbents are accelerating the adoption of Agile working practices and associated culture to achieve the Economies of Speed which are part of a start-up’s DNA.

Moving to embedded insurance is happening e.g. Tesla

There is the emergence of embedded insurance where a business or manufacturer starts to offer insurance products and services to its customers either directly or acting as a channel partner. A good example is Tesla which has recently announced it will be offering insurance products directly to its customers.

No matter what your views are, it seems certain to me that disruption in the insurance industry is set to continue to accelerate which may result in significant changes in the industry. Coupled with emerging technologies, such as autonomous vehicles and IoT, the shape of the insurance industry is very likely yo look very different within the next decade.

What do you think?